What a year! Sales into new territories, increased market share and margins, plus magnificent social metrics. In the calendar year we launched another lo-fi wine (FOMO), a brazen cocktail (Make out like a bandit) and gathered numerous glittering prizes.

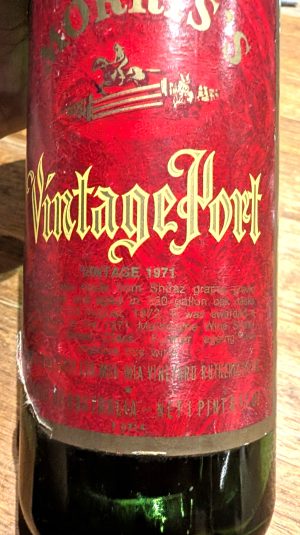

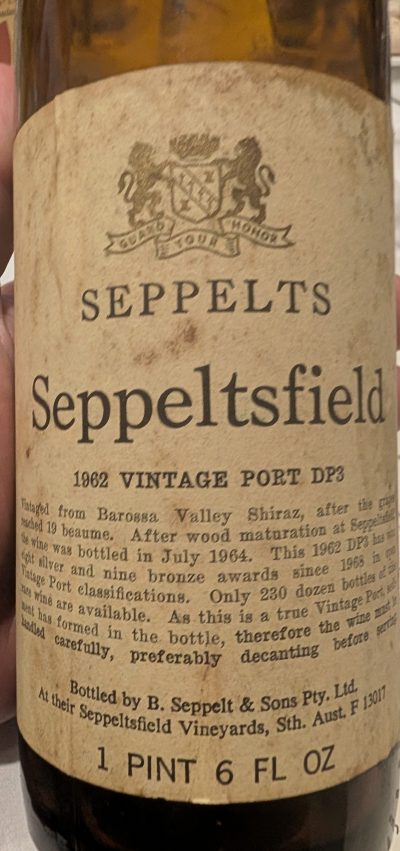

Stoney Goose Ridge is fanatical about delivering quality. I am not interested in offers of forty cent per litre wines. Small batches, and exclusives can excite our beverage professionals. They love shiny new toys, but recognise that I have the skills to market, and the touch to transform potential to memorable. We have acquired some special sites that will form part of our notorious and sought-after DRC range (we added Commodore G this year).

My own recent activities include grading all staff, determining internal movements, and setting KPIs; sorting through the thousands of applications for positions (AI-assisted resumes are instantly discarded). The data munchkins have been useful with their mining research; the wine, beer and spirit fabricators are constantly seeking my wisdom on optimising blends, marketing for my final approvals of campaigns, labels etc. Then there are the myriad approvals on expenses. I run a very tight ship. While we engage consultants, contractors and so on where we have special needs, it is a condition that knowledge transfer occurs – or else. Then there are my related duties on Government committees, industry organisations, keynote speaking at conferences in Vancouver, Buenos Aires, Lyon, and Adelaide plus all the media requests for my astute commentary.

My dedicated team of PAs, personal trainers, stylist etc have been kept nimble. I was bemused when my driver notified me of a recent piece of “transport infrastructure” near our hub – a bus shelter.

Stoney Goose Ridge amazingly receives questions about its standard contracts. But our position is simple – people are very free to endorse the contract, or not, with the date of effect as the variable. Similarly, we reject any contracts until our team has scrutinised and modified. We employ more, and superior legal teams, and take very advantage possible, with boundless litigation underway, and lucrative and embarrassing consequences for many that opposed us.

Our projects roll on – Pluribus, Vecna, Gorgon, and Beachhead being significant.

I take pride in finessing well-deserved incentives, deals and support from multiple layers of industry and tourism agencies. Similarly our ceaseless efforts to minimise the assorted taxes, levies, fees, and charges that dent our bottom line.

It was tough to achieve KPIs, and even I just scraped a meagre bonus. I accept that the two weeks I took in Hollywood to progress the film of my novel, didn’t help, despite my oversight of the people left in charge in my absence. They did not receive a holiday bonus and had to spend significant time reflecting and learning from their shortcomings. We continue our own performance-based termination policy, with accelerated attrition.

Our incompetent rivals, their Boards, and executives with the usefulness of chocolate teapots, have unfailingly delivered windfall after windfall; their flatlining and falling sales, belated moves into low and no alcohol alternatives, and their expensive marketing with the flair and excitement of roadkill. Their PR puff-pieces are majestical exercises in incomprehension. Examples “will derecognise its equity accounted investment and rerecognise this as a financial asset”; “We signed the MoU and are now working through the on-boarding process to understand its jurisdiction”; “Our future unlock biased towards our luxury portfolio, driving margin expansion through incrementally high efficiencies”; “Mission-focused on becoming the dominant sustainable delivery QSR in every market”. These corporate smokescreen statements are just a drop in the oceanic metaverse.

Honestly, their executives insist they were present and accountable – so were the curtains Their BAU policies of “insert wishful thinking here,” and their public performances evasive, disingenuous, unsatisfactory, and unresponsive. Reports from whistleblowers on the antics, ethical shortcomings corrupt and illegal activities of rivals have been highlighted and promulgated as part of our responsible public activities.

Apart from working breaks in Franschhoek and Monforte, and family time in Hakuba, and Telluride I note that I have only had a few long weekends with my family in Lizard Island, Freycinet, Thredbo, Dunkeld, and Broome. Add the usual motivational and essential relationship-building excursions to key markets supplementing the daily videoconferences, and travel consumes much time. My multi-tasking, strategizing, vision and problem-solving ensures there is no downtime wastage.

Spare time been spend working on the sequel to my best-selling novel. Publishers were aghast that I declined touring for promotional purposes, but my family and working life take precedence. I continue to help with the queries from translators about Australian idioms, and from Hollywood dealing with the on-progress movie.

Our pop-up outlets had outstanding success, and finally I relented thus we have a sale and tasting outlet at the Rocks, Sydney. Not just wine, we have a full range of attractive quality merch., all tastefully branded with the Stoney Goose Ridge logo.

Clothing – T-shirts, polos, puffer jackets, hoodies, socks, beanies, hats, scarves

Wine accessories – glassware, decanters, coasters

Stationery – posters, notepads, Jigsaw puzzles, colouring books, pens, crayons

Cooking – our award-winning ”Essential” cookbook, cutlery, gadgets

Miscellaneous- wallets, keychains, umbrellas and many more!

And of course we have tasting flights, museum wines, even an exclusive “on the Rocks” blend. Wines, beers, cocktails, spirits, all available for nominal tasting fees, plus snacks from the cookbook, it’s a day out for the whole family!

Enjoy the merrily festive seasonal break, before we resume our relentlessly successful voyage.

Your endlessly creatively magic skipper, Hector A Lannible.